Energy Star Homes

- Biraj Bhandari

- Jan 27, 2023

- 1 min read

Updated: Feb 21, 2023

To obtain an Energy Star certification for a single-family or multi-family residential building, the building must meet certain energy efficiency guidelines set by the Environmental Protection Agency (EPA).

Here are the general steps for obtaining Energy Star certification for a residential building:

Conduct an energy assessment of the building to determine its current energy performance.

Implement energy-efficient upgrades and improvements to the building, such as installing energy-efficient appliances and lighting, sealing air leaks, and improving insulation.

Verify that the building meets the Energy Star guidelines for energy efficiency. This can be done through a professional Home Energy Rating System (HERS) assessment or through a software tool called Portfolio Manager.

Apply for Energy Star certification through the EPA's online certification process.

Once the application is approved, the building will receive an Energy Star label, which can be displayed to show that the building is energy-efficient.

It's worth noting that the process may vary depending on the specific location, legislation, and program.

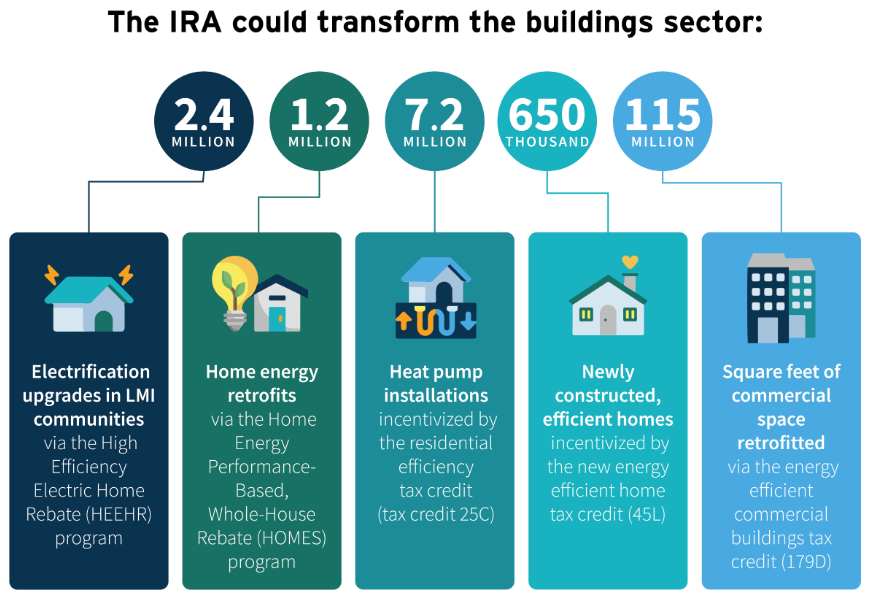

The Section 45L Tax Credit for Energy Efficient New Homes has been updated and extended through 2032. For homes and units acquired on or after January 1, 2023, the base level tax credit will be specifically tied to ENERGY STAR certification for single-family ($2,500), manufactured ($2,500), and multifamily homes ($500; or $2,500 when prevailing wage requirements are met).

_edited.png)

Comments