New Inflation Reduction Act Provisions for Buildings

- Biraj Bhandari

- Jan 27, 2023

- 5 min read

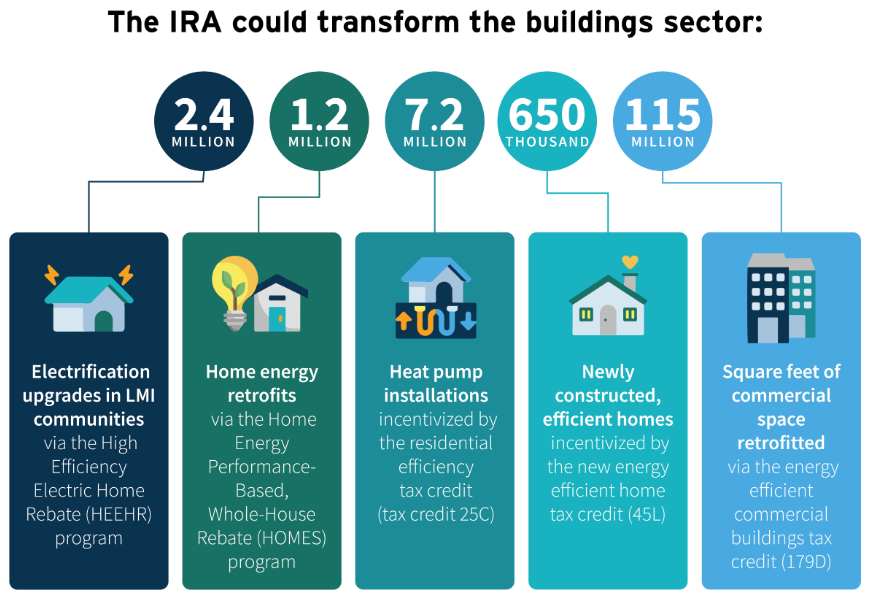

The newly passed Inflation Reduction Act (IRA) of 2022 contains two main types of building improvement financial incentives for efficiency upgrades and electrification: tax credits and rebates.

IRA building provisions include residential rebates and tax credits for an array of building efficiency, electrification, and distributed energy resources; incentives for developers and housing-providers with dedicated incentives for commercial and federal buildings; and funding for state and local building code implementation. The IRA also encourages adopting strong labor standards to promote high-quality jobs

Source: Rocky Mountain Institute (RMI)

Residential Rebates Program

IRA residential buildings provisions provide incentives for individuals, households (including low- to moderate-income (LMI) households), and multifamily housing owners and occupants to make home efficiency upgrades and replace fossil-fueled appliances with all-electric appliances. The most relevant provisions are:

1. High-Efficiency Electric Home Rebate Program (HEEHRA) includes $4.5 billion for LMI households to electrify with the most efficient equipment at a lower cost. These rebates will be offered through State Energy Offices (SEOs) and will likely be available in the latter part of 2023 once the U.S. Department of Energy (DOE) sets forth application guidance for states to receive the funding. SEOs will need to design their programs and distribute rebates to eligible households. The funding will be available starting 2023 through September 2031.

Source: Energy Innovation Policy and Technology, LLC

*Households that earn up to 80 percent of the area median income (AMI) can receive up to 100 percent of project costs, or up to $14,000 for all projects, whichever total is less. Households that earn more than 80 and up to 150 percent of the AMI are eligible for the lesser of 50 percent of project costs or up to $14,000 for total combined project costs.

2. Home Energy Performance-based Whole-House Rebates (HOMES) includes $4.3 billion in funding to support efficiency upgrades for all households, including LMI households. Incentive amounts will be determined based on the project’s modeled or measured energy savings.

Source: Energy Innovation Policy and Technology, LLC

Similar to HEEHRA, HOMES funds will be offered through SEOs with guidance from DOE, with funds likely available from 2023 through September 2031. DOE will approve procedures for determining modeled and measured home savings. Modeled performance rebates must be calibrated to historical home energy usage, consistent with Building Performance Institute standard 2400. Measured energy savings must be determined through open-source advanced measurement and verification software approved by DOE with data on monthly, and hourly if available, home energy use prior to efficiency retrofits. Contractors performing retrofits can receive a $200 rebate for each home retrofit located in a designated “underserved community,” defined by the IRA as “low-income or racial-minority communities, or communities disproportionately vulnerable to or impacted by economic, social, and environmental stressors.” While HOMES and HEEHRA incentives cannot be combined to cover the same equipment costs, LMI customers may take advantage of both rebates for different equipment.

Residential Energy Efficiency Tax Credits

1. Energy Efficient Home Improvement Credit (25C)

The IRA increases the value of the individual Energy Efficient Home Improvement Credit (25C) to 30 percent of efficiency project costs, including installation fees, up to different max credit values based on the efficiency measure. The IRA also extends the credit through 2032. Eligible technologies include heat pumps, heat pump water heaters, electric paneling, windows, and doors. The credit has an overall annual maximum value of $1,200, except for heat pumps and heat pump water heaters, which have a maximum credit value of $2,000. The annual tax credit maximum resets each year, which means additional installations can qualify each year between January 2023 and December 2032. The energy property credit can apply to costs for improving or replacing an electrical panel with a load capacity greater than 200 amps, installed either in conjunction with efficiency improvements or to enable future efficiency upgrades.

Source: Energy Innovation Policy and Technology, LLC

2. Residential Clean Energy Tax Credit (25D)

The IRA expands the Residential Clean Energy Tax Credit (25D). This 30 percent credit for distributed renewable energy generation equipment, such as solar panels and geothermal heat pumps, can now also be applied to battery energy storage systems greater than three kilowatt-hours. The IRA extends the credit through 2034, but it ramps down to 26 percent for installations in 2033, and 22 percent installations in 2034. Notably, the 25D and 25C credits can be combined to help households maximize energy savings and increase resilience.

New Energy Efficient Home Credit (45L)

The IRA expands the New Energy Efficient Home Credit (45L) and extends the credit through December 2032. The credit can benefit builders and developers and applies to both ground-up builds as well as major retrofits and renovations for single-family, manufactured, and multifamily homes, based on two standards for new construction: U.S. Environmental Protection Agency (EPA) ENERGY STAR New Construction and DOE’s Zero Energy Ready Homes:

▪ EPA’s ENERGY STAR Residential New Construction homes are “at least 10 percent more efficient than homes built to code” and average an efficiency improvement of 20 percent. The program includes whole-home efficiency requirements, from HVAC to water, lighting, and building envelope. As new program versions with improved efficiency requirements are released, they will need to be met to receive the credit in subsequent years.

▪ DOE’s Zero Energy Ready Home (ZERH) represents a sizeable step-up from ENERGY STAR, achieving at least 40 to 50 percent more efficiency than a standard home. The doubling of the credit value is reflective of the increased efficiency. The ZERH program excludes gas furnaces from consideration, opting solely for electric heating.

Multifamily buildings that are built to either of the two program requirements are eligible for a five-fold credit increase if prevailing wage requirements are met.

Source: Energy Innovation Policy and Technology, LLC

Commercial Buildings Energy Efficiency Tax Deduction (179D)

Commercial Buildings Energy Efficiency Tax Deduction (179D) offers incentives per square foot of energy savings. Building upgrades meeting prevailing wage requirements and achieving onsite energy savings of 25 percent are eligible for a a tax deduction of $2.50 per square foot. Each percentage increment of onsite energy savings adds $0.10 per square foot to the tax deduction, maxing out at $5.00 per square foot for 50 percent energy savings. If wage requirements are not met, the credit starts at $0.50 per square foot for 25 percent energy savings and maxes out at $1.00 per square foot for 50 percent energy savings. While the funding doesn’t specify electrification, requiring savings from onsite energy use ultimately favors electrification pathways for cutting into a building’s largest energy consuming operations. For example, heating with electric heat pumps is three to four times more efficient than heating the same space with natural gas furnaces. Given that space heating makes up about 25 percent of a commercial building’s total energy use, switching to a heat pump can generate large energy and emissions savings. ACEEE estimates that replacing gas-fueled furnaces with electric heat pumps in all commercial buildings could reduce commercial building sector GHG emissions by 44 percent.

_edited.png)

Comments